QuickBooks Desktop, the renowned accounting software, offers a straightforward solution for voiding bills and payments in a closed month. By understanding the reasons behind this necessity and the step-by-step process, you can confidently navigate through this task and keep your financial records in order. Whether you need to correct an error, update information, or simply adjust your books, QuickBooks Desktop provides the tools to help you achieve your goals.

In this comprehensive blog post, we will explore the intricacies of voiding a bill and its payments in a closed month using QuickBooks Desktop. We'll explore the reasons why you might need to perform this action, the potential consequences, and the step-by-step instructions to guide you through the process.

Why would you need to void a bill in a closed month?

There are several scenarios where you might need to void a bill and its payments in a closed month using QuickBooks Desktop. One of the most common reasons is to correct an error or inaccuracy in the original bill. Perhaps you entered the wrong vendor, the wrong amount, or the wrong date. In such cases, voiding the bill and its associated payments allows you to rectify the issue and ensure your financial records accurately reflect the correct information.

Another reason to void a bill in a closed month might be due to changes in the business or supplier relationship. For example, if you've renegotiated the terms of a contract with a vendor, you may need to void the original bill and create a new one with the updated information.

Consequences of voiding a bill in a closed month

Voiding a bill in a closed month can have several consequences that you should be aware of. First and foremost, it will affect your financial statements, including your balance sheet, income statement, and cash flow statement.

Another consequence is the potential impact on your tax filings. If the voided bill was related to a tax-deductible expense, the adjustment may require you to amend your tax returns or make other adjustments to ensure compliance with tax regulations.

Additionally, voiding a bill in a closed month can have downstream effects on your accounts payable and cash flow management.

When it comes to managing your financial records in QuickBooks, you might need to void an invoice from a previous year. This can be particularly important for maintaining accurate historical data and ensuring that your financial statements are correct.

Steps to void a bill in QuickBooks Desktop

To void a bill and its payments in a closed month using QuickBooks Desktop, follow these step-by-step instructions:

- Open the Closed Month: Start by opening the closed month in which the bill and its payments were recorded. You can do this by navigating to the "Company" menu, selecting "Change Closing Date," and then choosing the appropriate month and year.

- Locate the Bill: Locate the bill you need to void by going to the "Vendors" menu and selecting "Vendor Center." Find the vendor and the specific bill you want to void.

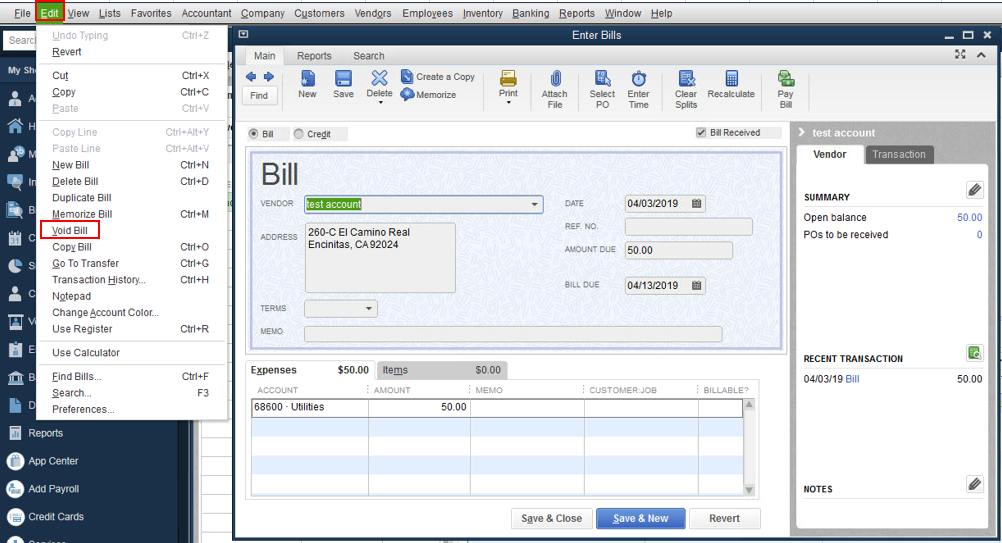

- Void the Bill: Right-click on the bill you want to void and select "Void Bill." This will open the "Void Bill" window, where you can review the details of the bill and confirm the voiding action.

- Void the Payments: Next, you'll need to void any payments that were made against the bill. Go to the "Banking" menu and select "Write Checks" or "Enter Credit Card Charges" to locate the payments you need to void. Right-click on each payment and select "Void."

- Adjust the General Ledger: After voiding the bill and its payments, you'll need to make adjustments to the general ledger to ensure that your financial statements accurately reflect the changes.

- Review and Reconcile: Carefully review your financial statements and reconcile your accounts to ensure that the voided bills and payments are properly reflected in your books. This step is crucial for maintaining the accuracy and integrity of your financial records.

- Document the Voiding Process: It's essential to document the voiding process, including the reasons for the action, the steps taken, and any adjustments made to the general ledger. This documentation can be valuable for future reference and audit purposes.

By following these steps, you can effectively void a bill and its payments in a closed month using QuickBooks Desktop, ensuring that your financial records remain accurate and up-to-date.

Best practices for voiding bills in closed months

To ensure the successful and efficient voiding of bills in closed months using QuickBooks Desktop, it's important to follow these best practices:

Maintain Thorough Documentation:

Carefully document the reasons for voiding the bill, the steps taken, and any adjustments made to the general ledger. This documentation can be invaluable for future reference and audit purposes.

Communicate with Stakeholders:

Inform relevant stakeholders, such as your accountant or tax professional, about the voiding process and its potential impact on your financial statements and tax filings. This ensures that all parties are aware of the changes and can take appropriate actions.

Verify the Accuracy of Adjustments:

Thoroughly review your financial statements and reconcile your accounts to ensure that the voided bills and payments are correctly reflected in your books. Double-check your work to avoid any unintended consequences.

Consider the Timing:

Whenever possible, try to void bills and their payments in the same month or fiscal period in which they were originally recorded. This helps to minimize the impact on your financial statements and reduces the need for extensive adjustments.

Implement Preventive Measures:

Establish processes and controls to minimize the need for voiding bills in closed months. This may include implementing stronger review and approval procedures, improving data entry accuracy, and regularly reconciling your accounts.

By following these best practices, you can efficiently and effectively void bills in closed months using QuickBooks Desktop, while maintaining the accuracy and integrity of your financial records.

Conclusion

Throughout this comprehensive blog post, we have explored the intricacies of voiding bills in closed months using QuickBooks Desktop. We've discussed the reasons behind this necessity, the potential consequences, and the step-by-step instructions to guide you through the process.

Read more:- All Causes and Stepwise Solutions for QuickBooks Error 1642